A mortgage is a loan designed for purchasing property, where the home itself serves as security for the lender. The borrower commits to repaying the loan, including interest, over a specified term, usually between 15 and 30 years. Mortgage rates can either be fixed, staying the same throughout the loan, or adjustable, changing over time based on market conditions. For many, this is the largest financial commitment they’ll make, so understanding the process is crucial. Here’s a step-by-step guide through the mortgage journey, from pre-approval to closing. Mortgage 101 – Understanding the Mortgage Process: From Pre-Approval to Closing:

1. Pre-Approval

Before house hunting, getting pre-approved is essential. Pre-approval involves a lender assessing your financial situation, including credit score, income, and debt. This helps determine how much you can borrow and gives you an idea of your budget. The lender will provide a pre-approval letter, which strengthens your position as a serious buyer. Remember, pre-approval is not a final loan commitment but an initial step based on a preliminary review of your finances.

2. House Hunting

With a pre-approval letter in hand, it’s time to search for your dream home. Knowing your budget helps narrow down options, making the search more manageable. Consider factors like location, amenities, property size, and future resale value. Working with a real estate agent can simplify the process by providing expert guidance and negotiating on your behalf. Once you find a home you like, make an offer contingent on securing a mortgage and passing a home inspection.

3. Lock & Appraise

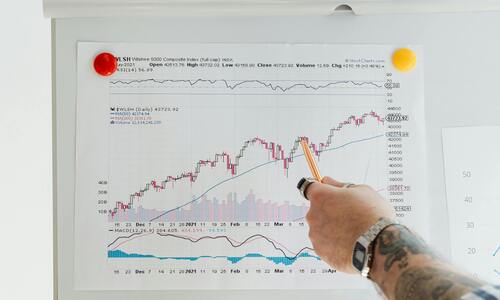

After your offer is accepted, the next step is locking in your interest rate. Interest rate locks protect you from fluctuations in rates while your loan is processed, ensuring your rate remains the same even if the market changes. Next, the lender will order an appraisal to determine the home’s market value, ensuring it aligns with the loan amount. A satisfactory appraisal is crucial, as a lower value might necessitate renegotiating the purchase price or increasing the down payment.

4. Underwriting

The underwriting phase involves a detailed review of your financial profile by the lender. They’ll verify your income, assets, debts, and credit history. The underwriter will also assess the property’s appraisal report and any additional documentation. During this time, you may be asked for extra information or clarification to support your loan application. A successful underwriting process results in a “clear to close” status, meaning the lender is ready to finalize the loan.

5. Closing Time

The final step is the closing, where you’ll sign the necessary documents to complete the mortgage. At closing, you’ll pay any remaining closing costs, such as appraisal fees, title insurance, and attorney fees. Once everything is signed and funds are transferred, you’ll officially become the homeowner. Be prepared for this step by reviewing all documents ahead of time to ensure there are no surprises.

When it comes to finding your dream home or securing the right mortgage, Our Custom House is your trusted partner. With personalized service and expert guidance, we simplify the process of buying, financing, and lending. Whether you’re buying your first home or exploring refinancing options, our dedicated team is ready to guide you through each stage of the process. Choose Our Custom House to turn your homeownership goals into reality—start your journey with us today.

*Areas we Serve:

– Florida

– North Carolina

– Georgia

– South Carolina

– Tennessee

*Interested in knowing more about Our Custom House? check out our blog

*Start building your bardominium now by clicking here, or contact us

Do you need assistance with calculating a mortgage loan? try our mortgage calculator

Please contact us at: (689)-263-0881

https://ultramoderngroup.com / https://ourcustombuild.com